Strengthening Resilience in the Financial Sector

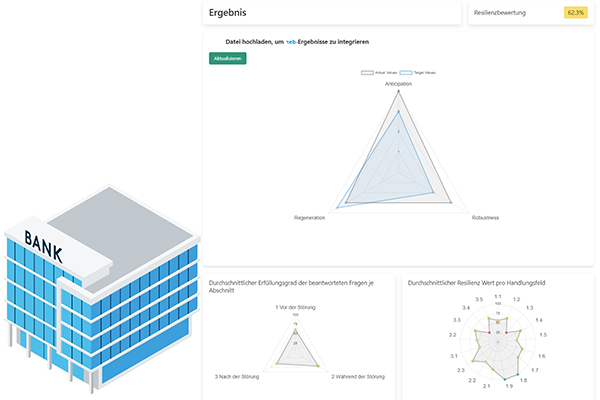

How well are banks and financial service providers prepared for future challenges? The new software RESMES, derived from RESilience MEasurment, supports financial companies in strengthening their resilience and developing targeted risk mitigation strategies.

Banks play a central role in the economy. Therefore, they are particularly vulnerable. Almost one-fifth of all global cyber incidents affect the financial sector. The International Monetary Fund estimates the damage over the past 20 years to be around $12 billion. However, it is not just cybercrime that challenges the financial sector; pandemics, inflation and interest rate shifts, wars, and geopolitical reconfigurations also pose significant threats.

Consequently, banks must proactively prepare for uncertainties and potential crises. The Fraunhofer Institute for High-Speed Dynamics EMI and the strategy, IT, and management consultancy zeb have developed RESMES, a software specifically designed to support financial companies. The goal is to create transparency in the complex risk landscape and provide concrete, scientifically-based recommendations for action.

Scientifically-Based Questionnaire Supports Users

Users can analyze and assess their resilience through a web-based, interactive questionnaire. Taking into account the desired target state, specific technical or organizational measures can be developed to further improve resilience, including compliance with regulatory requirements. "Companies not only identify their weaknesses but also track their progress," emphasizes Professor Alexander Stolz, head of the Security and Resilience of Technical Systems department at Fraunhofer EMI.

RESMES follows the five-phase concept of "Prepare, Prevent, Protect, Respond, and Recover." This framework also guides the 61 questions, through which users receive initial information for their resilience assessment.

In the Prepare phase, companies prepare for disruptions, aiming to avoid damages wherever possible (Prevent phase). The Protect phase focuses on protective measures. When a disaster occurs, the emphasis is on quick and efficient response (Respond phase).

"After an incident, institutions should systematically learn from the crisis to better fend off future risks and improve their resilience in an iterative process. Learning from crises is crucial for resilience," emphasizes Stolz. "However, this requires a willingness to adapt established processes and allocate resources," he adds.

RESMES is Based on the Proven Fraunhofer Resilience Evaluator FReE

RESMES is based on the Fraunhofer Resilience Evaluator FReE, which researchers at Fraunhofer EMI developed during the COVID-19 pandemic to provide companies across all industries with practical resilience measurement tools. "The new software demonstrates how research and practice work together to strengthen future security—a central concern of our work at Fraunhofer EMI," says Stolz.

Press photos for download

The new software RESMES, derived from RESilience MEasurment, supports financial companies in strengthening their resilience and developing targeted risk mitigation strategies.

Based on a web-based, interactive questionnaire, financial institutions can analyze and assess their resilience using 61 questions.